Managing finances is a crucial aspect of running a law firm or practicing as a lawyer. To ensure proper handling of funds and maintain compliance, it is essential to have three distinct bank accounts: an operating account, a savings account, and a trust or IOLTA account. In this blog, we will explore the purpose and significance of each bank account for lawyers and how DigitsLaw’s trust accounting feature can help you stay compliant.

The Three Types of Bank Accounts for Lawyers

Operating Account

The operating account is the primary bank account used for day-to-day business operations. It is where you deposit client payments, pay business expenses, and manage cash flow. This account should be separate from your personal finances to maintain financial clarity and avoid the commingling of funds. For example, a law firm might use its operating account to pay rent, utilities, employee salaries, and other operational expenses.

Savings Account

A savings account is essential for setting aside funds for taxes, emergencies, or future business investments. It allows you to accumulate reserves and ensure stability in times of unexpected financial challenges. By regularly transferring a portion of your revenue to the savings account, you can prepare for tax obligations, build a financial cushion, or make strategic investments. For instance, a lawyer may use their savings account to save for quarterly tax payments or invest in professional development courses.

Trust or IOLTA Account

A trust or IOLTA (Interest on Lawyers’ Trust Accounts) account is specifically designated for holding client funds that are entrusted to the lawyer or law firm. This account ensures the separation of client funds from the lawyer’s personal or business funds and helps maintain compliance with legal and ethical obligations. Client funds held in trust, such as retainers or settlement proceeds, must be deposited into this account. Interest earned on the account is typically transferred to a state’s legal aid fund. For example, an attorney might use the trust account to hold advance fees or retainers received from clients.

The Importance of Keeping These Three Attorney Bank Accounts

Maintaining separate bank accounts for operating, savings, and trust funds is crucial for several reasons. It helps maintain financial transparency, prevents commingling of funds, simplifies accounting and reporting, ensures compliance with legal and ethical obligations, and protects client funds. Separating business and personal finances fosters financial discipline, enhances credibility, and promotes trust with clients.

Tracking Transactions in Each Account

Properly tracking transactions in each account is vital for accurate record-keeping, financial reporting, and compliance. Ensure that all income and expenses related to your law practice are correctly allocated to the appropriate account. This can be achieved by diligently recording and categorizing transactions, maintaining bank statements and receipts, and utilizing robust accounting software like DigitsLaw.

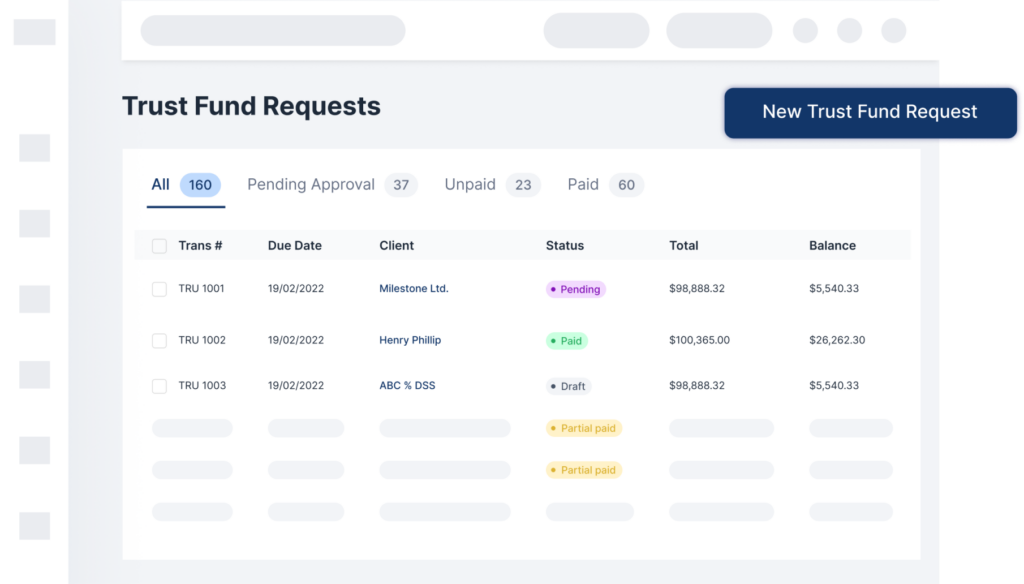

How DigitsLaw Trust Accounting Can Help You Stay Compliant:

DigitsLaw’s trust accounting feature is designed to simplify and streamline the management of client trust funds. With DigitsLaw, you can easily record trust deposits, track client balances, generate client statements, reconcile transactions, and maintain an audit trail. The software provides the necessary tools to ensure compliance with trust accounting rules and regulations, saving you time and reducing the risk of errors.

In conclusion, having three separate bank accounts for lawyers – operating, savings, and trust – is essential. Each account serves a distinct purpose and contributes to financial transparency, compliance, and business stability. By utilizing DigitsLaw’s trust accounting feature, you can effectively manage your trust funds and stay compliant with ease.

Remember, consulting with a legal or financial professional is always recommended to understand the specific requirements and regulations related to trust accounting in your jurisdiction.