In today’s economy, many people find it difficult to afford the cost of legal services. This in turn makes it difficult for them to access the legal representation they need. To accommodate these constraints, law firms are now introducing lawyer payment plans to provide their clients with a more affordable way to access the legal services they need.

Implementing lawyer payment plans can be a great way to make legal services more affordable and accessible to a wider range of people. It can also help law firms to improve their cash flow and reduce the risk of bad debt. However, implementing payment plans can be tricky. In this blog post, we will explore everything you need to know about using payment plans at your law firm.

Image Source: Vecteezy

What Are Lawyer Payment Plans?

Lawyer payment plans, also known as legal fee installment plans, are arrangements between law firms and their clients that allow for the gradual payment of legal fees over an agreed-upon period. Instead of requiring clients to pay the entire legal fee upfront, a payment plan breaks down the cost into manageable installments. This financial flexibility can make legal services more accessible to a broader range of clients, particularly those who may not have the immediate financial means to cover the full cost of legal representation.

Benefits of Accepting Lawyer Payment plans

Offering lawyer payment plans can be a beneficial strategy for both law firms and their clients. Here are a few of the advantages:

Increased Accessibility to Legal Services: Payment plans make legal services more accessible to a broader range of clients, especially those who may not have the financial means to pay the full amount upfront. This expands the client base and allows law firms to serve wider people.

Improved Cash Flow For Law Firms: Payment plans provide a steady stream of income for law firms, enhancing cash flow and financial stability. This predictable revenue stream helps firms plan for future expenses and make informed financial decisions.

Reduced Administrative Burden: Payment plans simplify the invoicing and collection process, reducing administrative tasks. And, if you’re using a tool like Digitslaw, you can automatically charge and send invoices to your clients, who will receive a notification via the client portal.

Enhanced Client Satisfaction: Offering flexible payment options demonstrates a concern for clients’ financial well-being and fosters positive client relationships. This can lead to increased client satisfaction, loyalty, and referrals.

How To Set Up Lawyer Payment Plans For Your Law Firm

Define Your Payment Plan Policy

Establish transparent and well-defined payment terms for your clients. Clearly communicate the duration of the plan, the amount of each installment, any interest or fees involved, and consequences for missed payments. Here are a few factors to consider:

- Eligible clients: Determine who qualifies for payment plans, such as new clients, specific case types, or clients with financial constraints.

- Payment structure: Decide on the payment structure, such as fixed monthly payments, a percentage of the total fee, or a combination of both.

- Payment duration: Establish the duration of the payment plan, considering the complexity of the case and the client’s financial situation.

- Late payment fees: Define the late payment policy and any associated fees for missed payments.

Draft a Payment Plan Agreement

Create a clear and comprehensive payment plan agreement that outlines the terms and conditions agreed upon between the law firm and the client. Every client needs to sign an agreement before you confirm you’ll bill them using a payment plan. This agreement should include:

- When your law firm will collect payments. monthly, or quarterly?

- What payment methods you’ll accept. How the money will be paid to your law firm. Will it be by check, bank transfer or credit card?

- Client’s signature and date: A clear indication of the client’s agreement to the payment plan terms.

Include anything else you think will help clarify the terms of your payment plans for clients. Clear communication is critical for setting expectations.

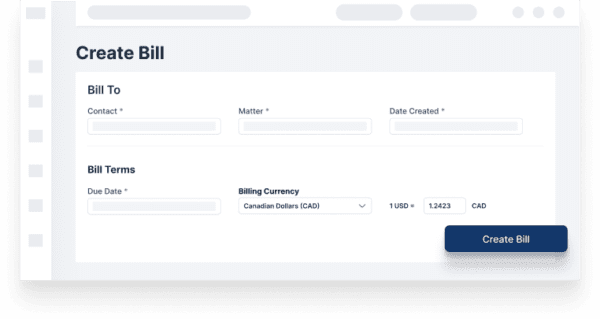

Set Up A System For Billing Clients

Consider implementing software or billing systems that automate the tracking and management of payment plans. This can streamline administrative tasks and ensure accurate record-keeping. To start, select a secure and reliable payment processing system to handle payments. Make sure you choose payment methods that are convenient for both the law firm and your client.

For example, with Digitslaw, you can easily automate online billing. Once you set up a payment plan for a client, you can automatically charge the payment amount on each scheduled payment date. With the automated Digitslaw payment plans feature, you can significantly lower the risk of error that comes with managing payment plans manually. This also reduces the time law firms spent on invoicing and collections. Schedule a demo to learn more about Digitslaw.

Monitor and enforce compliance

Regularly monitor client payments to ensure they are adhering to the agreed-upon terms. Promptly address any missed payments or issues that arise by following up with reminders or implementing appropriate actions outlined in your agreement.

How To Leverage Technology When Implementing Payment Plans

Incorporating technology into your lawyer payment plan implementation can streamline operations, enhance client satisfaction, and boost your firm’s financial stability. Here’s how to go about it:

Digitslaw: The Legal Billing Software

Digitslaw legal billing software makes it easy to set up payment plans, send invoices and give clients real time updates about their payment via the client portal. Clients can also settle payments easily through third-party payment gateways like Stripe, PayPal, Flutterwave, or Wave. With Digitsaw, you can expand your client base to different countries. Send payment requests easily in their currency of choice and receive payment in the currency of your choice. The great thing about Digitslaw is that you do not need any accounting integration. We have a built in robust accounting system that manages your law firm’s general ledger. This means you can seamlessly track every client payment even if they’re spread out over time.

By implementing lawyer payment plans at your law firm, you can provide greater access to legal services while also mitigating financial risks. This approach can attract a wider client base and foster long-term relationships with clients who appreciate the flexibility and affordability of your payment options.